|

Homes for sale in Brandon, Valrico, Lithia, Riverview, Gibsonton, Apollo Beach & Tampa. |

|

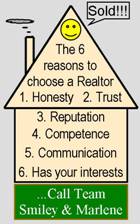

' 813.600.3292 Team Smiley & Marlene |

|

' 813.600.3292 Smiley & Marlene Papenfus |

|

Click on this link → to search EVERY MLS listed property in Tampa & surrounding areas. The above link is YOUR access to the Multi Listing Service, enabling you to accurately search every available active property listed by over 5,000 realtors in the Mid Florida Region. Most Real Estate web-sites are searching outdated listings that have contracts or are already sold. The above link searches the same up to date database that we as realtors use. How much Real Estate can I afford? How much will my Mortgage Payment, Insurance and Property Taxes come to? MORTGAGE CALCULATION BELOW... |

|

Property Search |

|

PITI CALCULATIONS (Principal, Interest, Taxes & Insurance) Answers to 1/29/08 amendment 1 tax savings - Portability tax calculator To calculate your annual property taxes, simply multiply the assessed value by the millage rate of 0.020306 (for 2008 - which is adjusted slightly each year to meet Floridas annual budget). Remember, taxes are paid in arrears, i.e. you pay end of this March for last years taxes. In Florida you dont pay State taxes, just property taxes and 7% sales tax (which is also used to fund public education through to K-12). Of course we also pay Federal taxes. Example 1: Purchase a home for $240,000, which will have about a 17% lower assessed value of $200,000 x 0.020306 = $4,061.20 annual property taxes OR $338.43 per month. If the home is your PRIMARY RESIDENCE, you need to apply for Homestead exemption which effectively reduces the taxable value of your home by $50,000. Click on this link >> to see all property tax exemptions available in Florida. Homestead exemption also limits the annual increase of your property taxes to no more than 3% - a huge long term tax saving. Click on this link >> for details on filing for Homestead exemption. Example 2: With Homestead exemption your $200,000 assessed home would only be taxed on $150,000 x 0.020306 = $3,045.90 OR $253.83 per month - thats a $84.61 saving per month - which just may be the little extra you need to get into that nicer home. DISCOUNTS for early property tax payment are applied during November (4%), December (3%), January (2%), and February (1%). No discount is allowed on March payments. From April 1, last years taxes become overdue. Example 3: Example 2s taxes of $3,045.90 less 4% = $2,924.06 OR $243.67 per month - thats a tidy $94.76 saving per month off Example 1s monthly payment. I highly recommend a Mortgage Broker who is highly efficient, reliable & honest - Tommy Gainer - 813.315.2973 - he has pulled off miracles for me and got people into homes when no one else was able to help. He will be able to supply you the required PRE-QUALIFICATION LETTER TO BUY over the phone as a free service. PAGE DOWN... |

|

Click on these links >>> for tips to lower your property taxes - Answers to 1/29/2008 amendment 1 tax savings - New portability tax calculator. |

|

For a quote on Home Insurance call Peggy Clarkson, from >> All State Insurance - 813.236.2994 or 813.404.1657 C - I recommend him for his excellent customer service, honesty to act in your best interest and for saving me a few $100s on my home & auto insurance. WASHINGTON July 7, 2009 Mortgage info available at your fingertips Although the mortgage lending crisis put a serious squeeze in the housing market, the situation has also produced attractive low borrowing rates for prospective homebuyers who can qualify for a mortgage. Moreover, the federal government has offered an $8,000 tax credit for first-time homebuyers through Dec. 31, 2009. What should a person know about securing a home mortgage, and the different types of mortgages available? A spin on the information highway will turn up a bevy of answers. Several Web sites provide tips and information about qualifying for a mortgage. Here is a sampling of sites:- |